Aiming to maintain a biodiesel policy known as B40, Indonesia has tightened exports of palm oil byproducts and used cooking oil.

Farmers on the Line

The export curbs could hurt palm farmers’ revenue, cites Majalah Hortus in a January 11, 2025 story.

This is because franchise growers can only sell their raw material to affiliate mills while independent growers have little competitive choice.

Hence, the chairman of a national palm farmers association, Gulat Manurung, called for restrictions to over 160 export markets to stop.

Gulat also invoked the high international demand for used cooking oil and palm residue. This could otherwise have provided a prime export opportunity for hardworking oil palm growers.

Regulations

Such hopes ebbed with the publication of the Regulation of the Minister of Trade Number 26 in 2024, revised January 2025.

Since then, Palm oil mill effluent (POME) and used cooking oil (UCO) have become highly regulated products.

As the biggest palm oil producer, Indonesia is switching its energy sector to biodiesel, constituting around 40% of diesel.

For this to be a reality, energy processors must feature 40% palm biodiesel in each measure of diesel. Exports of oil residue must not also exceed 300,000 tonnes per year.

Gaining Exports

Nevertheless, export trade of POME and other palm byproducts grew exponentially at 20.74% annually between 2019 and 2023.

Although exports have lately reduced between January to October 2024, POME exports still reached 3.45 million tonnes. This is more than 10 times the recommended export total.

But in 2023, palm oil byproduct exports hit 4.87 million tonnes, above crude palm oil shipments at 3.60 million tons.

Crude palm exports have been falling, reaching their low point in the January-October 2024 timeline at 2.70 million tonnes.

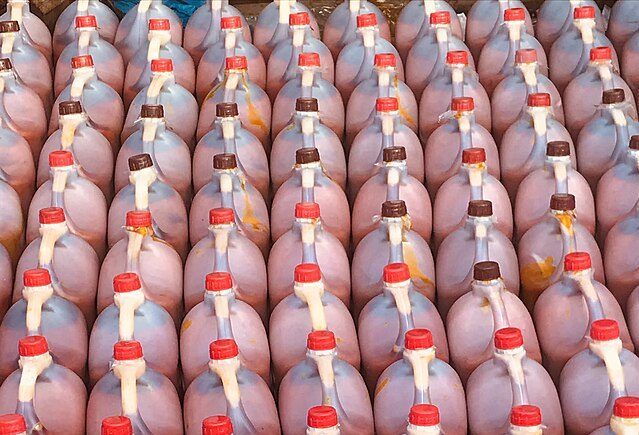

Cooking Oil

Despite the successful cuts on crude palm exports, mischief is still dogging the sector with traders mixing pure with used cooking oil.

This activity owes to greed to reach export quotas for the product by incorporating pure cooking oil.

Suggestions on how to cut this roquery include increasing duty on byproduct shipments amid other legal measures.

All in all, the controls seem to be working for Indonesia saw its domestic palm oil consumption grow by 8.90% in 2023. And as the next data section highlights, this growth partially owes to the ongoing export controls of palm residue.

Indonesia Palm Residue/Byproducts Export Statistics

Although Indonesia and neighboring Malaysia both produce 83% of the global palm oil, the bulk stays at home. The government upped palm oil duty by 10% to favor local sales, leading to January-October 2024 exports to drop to 2.70 million tonnes. The next campaign underway is targeting palm byproducts exports. Since January 8, 2025, Indonesia has been clamping down excess exports of palm oil residue and used cooking oil. The country aims to realise its B40 mandate where all diesel fuel must contain 40% palm biodiesel, up from 35%.

The preliminary restrictions in 2024 seem to be working: between January and November 2024, used cooking oil and palm residue exports decreased by 13.75%, year-on-year, to 3.95 million tonnes. But with the government aiming to reduce exports to just 300,000 tonnes per annum, there is still a long way to go.

Does palm oil produce cooking oil in Indonesia?

Palm oil in Indonesia processes the affordable Minyakita cooking oil. In early January 2025, however, retailers of Minyakita sold it at a 1/10th above the governmental fixed price. This prompted shortage concerns and hence export curbs.