The ongoing coffee harvest in Brazil has recently occasioned a fall followed by a sharp rebound in world coffee prices.

On June 24, 2024, global prices spiked after an earlier drop following news of increasing dryness in Minas Gerais. This state in southeast Brazil supplies 30% of national Arabica.

September Arabica deliveries edged 5% up even as Robusta for July delivery closed 3.61% up on the International Coffee Exchange (ICE).

By the morning of June 25, 2024, global coffee prices on day trading platforms were at $2.37 a pound. This is almost equal to the highest price so far in 2024, on April 15, at $2.41 a pound.

Harvest Cools Prices Temporarily

The above price rally sharply contrasts with the $2.27 a pound rate following a June 17 harvest-fuelled major inventory recovery.

As the coffee harvest in Brazil progressed, inventories hit 831,595 bags on June 20 and dragged down prices.

A few days earlier on June 18, the harvest was at its 44% completion mark, higher than that of the corresponding 2023 season when it had been 39% complete. The harvest helped bring global supplies to 831,595 bags, the highest since November 30, 2023’s 224,066 bags.

Consequently, the price fell prey to market forces on the week ending June 21. The ICE futures recorded a 1.67% price drop for July robusta deliveries and a 2% dip for September Arabica deliveries.

Dry Times

For now, a current 3-week consecutive dryness in southeastern Brazil looks likely to keep prices up for sometime.

One of these is the Minas Gerais coffee belt which occupies a part of Brazil’s seasonally dry tropical forestland. On June 17, the weather department reported a fortnight without rain in Minas Gerais, echoing a similar dry spell in May 2024.

Together with Sáo Paulo and Paraná states, Minas Gerais supplies 80% of the total Arabica coffee in Brazil.

Ultimately, the weather-affected coffee harvest in Brazil has the global price on edge, despite high production expectations for 2024. And as the following statistical picture of Brazilian coffee performance shows, the country’s production is a global influencer.

Brazil Coffee Statistics

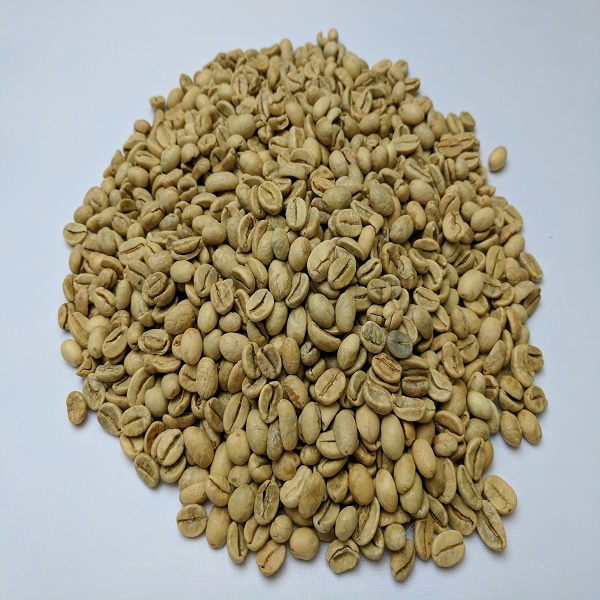

Brazil is synonymous with coffee and is the world’s biggest source of coffee at 40% of global production as of 2021. Arabica production is 76% and Robusta 23%. This production dominance did not begin in the 21st or 20th centuries but in the 19th c., as early as the 1840s. Since then, Brazil has grown into a coffee giant with 220,000 orchards across 10,000 square miles of its territory. Besides, Brazil accounts for 32% of global coffee exports, as of 2021. In 2023, the country exported 64% of its 2022-23 coffee crop that totaled 55.07 million bags.

Which is the most popular coffee variety in Brazil?

Specialty coffee such as espresso leads demand in Brazil despite costing 6 times more than commodity coffee. However, cheap sweet-tasting Arabica and nutty-tasting Robusta beans are also popular in homes. Much of the Robusta output remains for domestic use while the bulk of the Arabica goes into export.

How much coffee do Brazilians consume?

In the 2021-22 market year, Brazil ranked 3rd worldwide in coffee intake, at 23.655 million bags. This is up from the 2020-21 consumption volume of 22.4 million 60-pound bags. However, in per capita terms, Brazil does not show up in the top 10 list. Rather, Norway led the per capita consumption at 12 kg per person per year in 2016.