Indonesia faces a crude palm oil (CPO) import challenge if it is to meet its 2045 production goal of 92.4 million tonnes.

According to Hadi Sugeng, the Secretary General of the Indonesian Palm Oil Entrepreneurs Association (GAPKI) in a Majalah Hortus report, a 27.1 million-tonne annual deficit looms.

Hadi cited 40% or 6.57 million hectares of the country’s oil palm acreage is aging and needs replanting.

Secondly, production has stagnated at 3.2 to 3.3 million tonnes a hectare in the last couple of years.

More so, Indonesia’s crude palm oil exports that average 30 million tonnes per year must continue despite pressing domestic needs.

A major aggravating factor is a reigning moratorium in Indonesia against clearing forests for oil palm cultivation.

Regarding the above sustainability issue, Hadi pointed out that the government can forestall future imports through land expansion.

“The option is that we at least open a new area,” he suggested, to enable production reach 92.4 million tonnes.

He specified the need for 4.5 million extra hectares over the current 16.38 million hectares to realize 2045 CPO goals. This way, exports could reach 42 million by 2045, even as home production of biodiesel hits 50 million tonnes.

Biodiesel

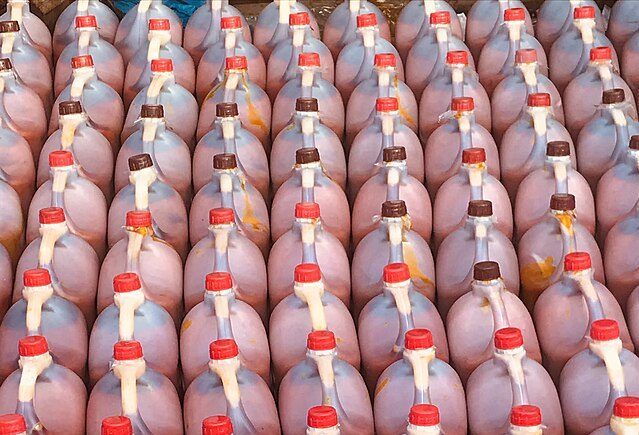

Speaking of which, Indonesia uses its non-exported palm oil in biodiesel, oleochemical and food production.

Because of its importance, biodiesel has become ubiquitous in Indonesia. In 2023, the country made it imperative that diesel in sale locally must contain at least 35% biodiesel.

The move met with expectations of a palm oil export decline. However, companies strove to meet the goal by renewed replanting of aging trees.

This is why Haji now recommends new cultivation areas to increase biodiesel production, boost exports and finance replanting projects. While biodiesel boosts domestic revenue, palm oil exports bring foreign exchange, part of which channels back to farms.

In short, as Indonesia foresees possible crude palm oil imports, the nation also deliberates how to boost production without deforestation. And as the statistics below show, top-level production is a major issue in CPO exports.

Indonesia Palm Oil Statistics

Indonesia led global palm oil production in the 2022-23 market year at 45.5 million tonnes, followed by neighboring Malaysia. The country also ranked as the number 1 user of palm oil in the world at 20.1 million tonnes in 2023. India, China and the European Union followed in usage at 9.325 million, 6.95 million and 4.6 million tonnes respectively.

How much biofuel does Indonesia derive from its crude palm oil?

In 2013, 12% of Indonesia’s palm oil went into biodiesel production while 73% to food products, after subtracting exports. 10 years later, in January 2023, Indonesia began including 35% biofuel content in motor oil, per the B35 Mandate. The law mandates mixing plant-based oils in diesel. Comparatively, only 5% of the world’s palm oil makes biofuel, while 68% features in food (margarine, cooking oil and fodder).

How much percentage of Indonesia’s palm oil is exported? Indonesia exports over 70% of its palm oil, which includes crude palm oil, biodiesel, food derivatives and oleochemicals.