A dry season, a milling revolution, upshot international coffee prices and a timely harvest have gifted Kenya’s premium coffee a temporary break.

Farmers have from November 2024 been enjoying high rates from roasters, spot on the country’s strategic October-December harvest.

Weekly prices at the Nairobi Coffee Exchange on December 4, 2024 shows grade AA cost between $292 and 380 (37,5950-48,925 shillings) per 50 kg.

Government officials indicate that a 50-kg bag used to auction at $188 per 50 kg before the market reforms. After the reforms the 50-kilo value had inched up to $237 by September 2024.

These handsome earnings could persist up to the next harvest around April 2025, although weather vagaries may have eased the shine.

Besides, international millers have been quitting operations in Kenya following the reforms, allowing farmer cooperatives to have a go at milling. Some co-ops want to sell at least 5% of their beans fully processed, directly to international buyers at a profit.

This follows the ratification of the Coffee Regulations [2019] and Capital Markets Regulations [2020] in 2023, impacting coffee milling licensing.

Dry Spell Coffee

Currently, coffee is gaining from sporadic dryness in major producers from not only Kenya itself but Brazil and Vietnam.

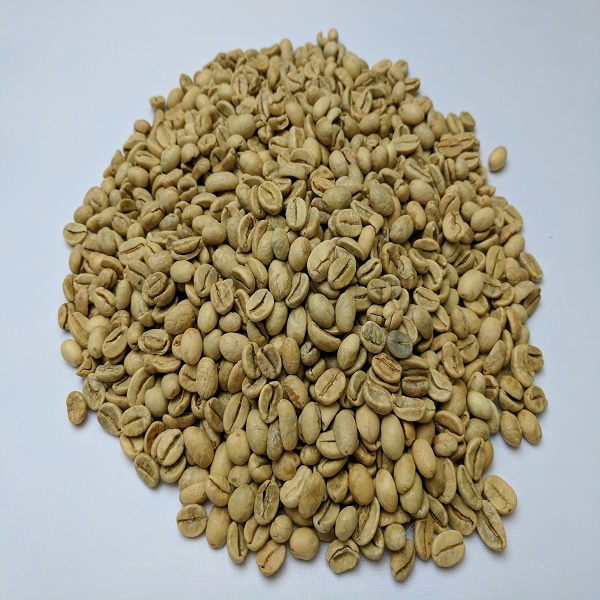

Brazil and Kenya are sources of high-quality Arabica, such as Kenya’s competitive AA beans, while Vietnam leads global Robusta production.

The dry season in the highlands of Kenya falls roughly between January and February. Although this is normal since the coffee harvest occurs twice a year during the rainy seasons, it is nevertheless undeniable that adverse climate has cut production.

Annual production has downsized to around 48, 648 tonnes worth $32.9 billion shillings ($251.86 million), as of 2022.

The figure above indicates a slump from the historical highs of 130,000 tonnes in the past decades.

Premium Coffee Destination

Compounded by rising international prices due to shortage, prime Kenya coffee prices are affecting pricing in the lucrative American destination.

The U.S. purchased some 0.74% of its foreign coffee from Kenya worth $66 million in the 2021-22 season, according to OEC.

Popular purchases from Kenya include AA beans, whose high cost makes related coffee products expensive in the destination markets.

In short, Kenya’s premium coffee stands at a crossroads between high foreign demand and climate vagaries. To learn more, below is a statistical outlook of the country’s coffee sector.

Kenya Coffee Statistics

Coffee in Kenya goes back to the late 19th century when British settlers introduced it. Since then, it has been growing at the heart of the central highlands and the Rift Valley at 1,000-2,000 m altitude. While farming can be an individual or corporate effort, marketing is normally a co-operative partnership. Thousands of small-scale farmers form a single cooperative that averages 4 million kg of coffee per season, especially in Central Kenya and Nandi Hills.

Although Kenya is still in the top 25 of production (it ranked 22nd in 2019), output has nevertheless fallen from 130,000 tonnes to 45,000 tonnes. Indeed, the U.S. Department of Agriculture estimates 2024-25 production at 750,000 60-kg bags of coffee, a 6.3% yearly depreciation.

Production patterns have stagnated despite acreage expansion due to acidic soil degradation. In 2022, for instance, production, at 51,900 tonnes, was more than 2023’s 48,700 tonnes. This despite 2022’s acreage, at 109,400 hectares, being less than 2023’s 111,900 ha, per FAOSTAT.

Is Kenya a major coffee exporter?

Kenya is a top 25 coffee exporter, a rank it retained in 2023 by earning $260.983 million in export turnover. According to a January 2024 USDA forecast, Kenya’s exports in the 2024-25 season would depreciate to 720,000 60-kg bags.

How much do farmers in Kenya earn as a proportion of brewed coffee cup price abroad?

Because much of Kenya’s coffee undergoes export, it is only natural to compare wages at home and prices abroad. While Kenya’s smallholder farmers earn between $1.40 and $2.30 a day, a cup of coffee in London costs $4, according to the BBC.