The main biannual Robusta coffee harvest in Vietnam continues mid-November 2024, bringing with it mixed pricing dynamics.

By November 8, the bountiful harvest had impacted prices downward by 20% since the April high, to 106,000 dong ($4.17) a kg.

Zooming in a week later, international market dynamics favored prices, helping Vietnam’s farmers earn more for their beans.

As the global Robusta prices rallied, Vietnam’s hit an upper threshold of 110,800 dong ($4.36) a kilogram on November 14, 2024. This in turn marked a 4.5% weekly rise.

January contractual deliveries in their part increased by a weekly margin of $95 (2,411,100 dong) to $4,632 (117,560,160) a tonne.

The likelihood of the typhoons currently hammering southeast Asia bringing rain amid the harvest is adding strength to the price.

Another helpful factor for the domestic price rise is the depression in coffee supplies in nearby Indonesia.

2023-24 Season Ends with Pricey Robusta

The start of the 2024-25 coffee harvest in Vietnam inherits a commercially successful 2023-2024 season, which has just ended.

The foregoing season’s export price had by October 2024 risen by 57% year-on-year, to average $3,981 a tonne. This is the highest median in three decades.

Apparently, Robusta beans reached a point where they edged the export price of the conventionally expensive Arabica beans.

As the biggest Robusta-exporting nation, Vietnam buffers global supplies of this variety and often benefits from sharp price surges.

Vietnam exported 1.46 million tonnes between October ‘23 and October ‘24, a yearly decrease of 12.1%. Nevertheless, the robust price factored in to bring a 33% surge in yearly coffee export revenue of above $5.4 billion.

The country therefore seems on target to realize its dream turnover of $6 billion by 2030, through deep processing of coffee beans.

These impressive returns therefore point out why Central Vietnam’s farmers intimately dub the coffee plant “ATM tree.” Indeed, that intimate reference echoes the statistics below that show the financial strength at each harvest.

Coffee Harvest in Vietnam Statistics

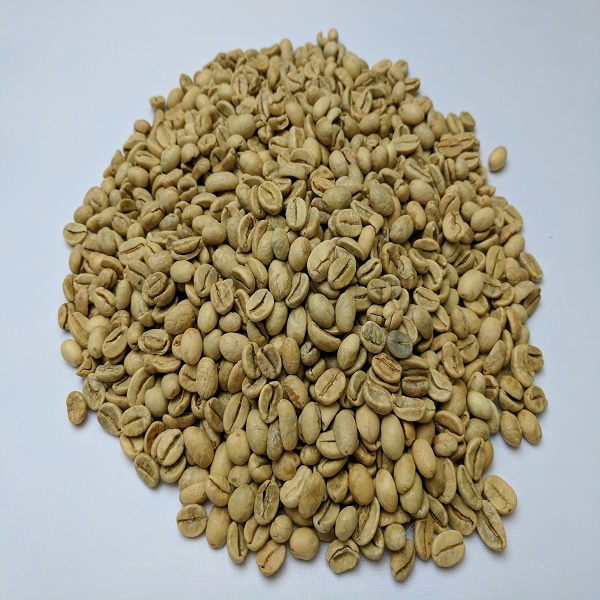

Farmers pick ripe coffee cherries two times per annual season that include October-February for Robusta and January-April for Arabica. The total crop amounts to 1.8 million tonnes, as of 2021, the second highest after Brazil. Of this total, Robusta makes up at least 95% of the beans while Arabica supplies the 5% remainder. Notably, each variety depends on the supply trends of the other, both locally and internationally, for pricing.

How have farm gate coffee prices in Vietnam performed each harvest in 2024?

End 2023-24 Robusta harvest prices reached 83,700 dong ($3.30) per kg on February 28, 2024, according to VN Express. Two months later on April 30, when supplies were dwindling, the price had picked to 135,000 dong ($5.31) a kg. This coincided with the end of the Arabica harvest that same month and Vietnam was experiencing dry conditions. Global Arabica prices were also at record highs at $2.39 per pound, up from $1.75 a pound in January.

How have successive coffee harvests performed historically in Vietnam?

Vietnam has had an enviable relentless upward production since the 1980s due to heavy state investment. In 1985, production was below 5 million 60-kg bags, but had passed the 10 million 60-kg-bag limit by 2000. By 2021, the volume of production was more than double this figure at 26.3 million bags.