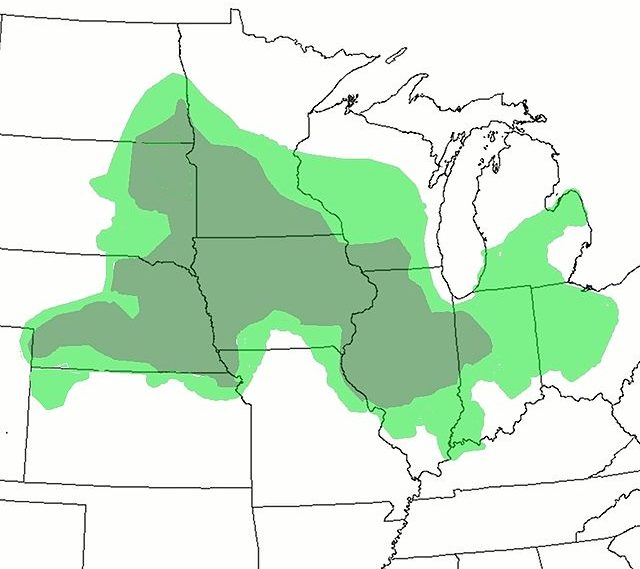

On Wednesday, grain prices in Europe and the USA continued to plummet. The background to this is the continuing rainfall in the corn belt of the USA. The rain triggered further massive sales on the futures markets.

Prices continue to fall due to the confirmed rains in the Corn Belt at the end of this week and the advanced harvest in Europe. “Just as weather and drought concerns drove the grain market higher, weather and rain forecasts are bringing the market back down,” says a U.S. analyst on the U.S. agricultural portal Successful Farming.

“It is likely that the market will continue to trend lower this week as rain continues to fall, but it is still important to think about how much yield has been lost so far and whether this rain is just a temporary trend,” it continues.

Rain also fell Thursday in the key two growing states of Iowa and Illinois, and more rain is expected to fall across the Corn Belt this week into early July. As a result, there is also extensive technical selling, which caused grain prices to plummet again on Wednesday. Wheat prices fell 4.5% in the U.S., while corn prices dropped more than 4% and lost 2.5%.

This also caused further price corrections in Europe. Wheat fell by a further 5 euros to 231 euros per ton on the European futures market on Wednesday. Corn prices fell by 5 euros to 234 euros per ton. Feed barley was quoted at 213 euros at the wholesale market and export port of Hamburg on Wednesday, down 3 euros from the previous day.

Weather conditions in Ukraine have also been generally favorable in recent months, supporting potentially higher production than previously expected, agritel analysts report.

Negotiations on the extension of the grain corridor appear to be at an impasse, and an increasing number of observers believe there may not be a positive outcome for the period after July 18.

Price pressure also came from a report from Statistics Canada’s StatCan. This reports that wheat acreage will exceed expectations and reach 10.9 million hectares, while canola acreage is expected to reach 8.95 million hectares, compared to 8.66 million hectares last year.

Agritel also reports that winter barley yields vary widely across France, depending on rainfall in different regions in recent months.

US crop report on Friday – accelerating price decline?

Grain prices are likely to fluctuate less today, analysts believe, because a key USDA report on stocks and acreage is expected on Friday (Jun 30).

Ahead of the reports, analysts expect USDA to report final corn acreage for 2023 at 91.85 million acres (37 million hectares), down from 88.58 million acres (35.86 million hectares) in 2022. “Large changes in these June reports tend to be the exception, but do occur,” says grain market analyst Bryce Knorr.Analysts expect total wheat acreage to be 49.66 million acres (20.1 million hectares). If realized, that would be nearly 1.6 million acres more than in 2022.

Source: Agrarheute.com